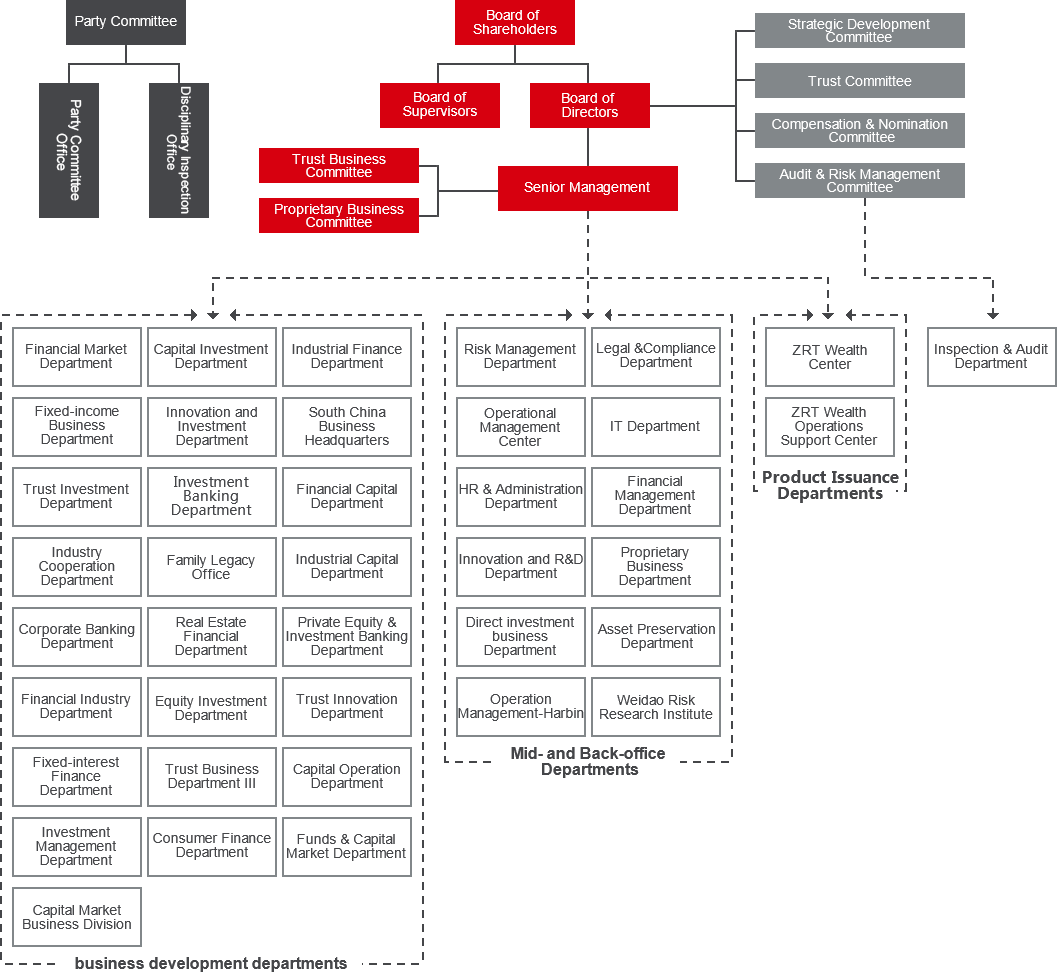

Zhongrong Wealth Center

Zhongrong Wealth Center

Wealth Operation Support Center

Wealth Operation Support Center

BEIJING ZHONGRONG DINGXIN INVESTMENT MANAGEMENT CO., LTD

Beijing Zhongrong Dingxin Investment Management Co. Ltd. (ZRTDX) is an investment subsidiary wholly owned by ZRT and approved by CBRC with a paid-in capital of 1.5 billion yuan. Filed with the Asset Management Association of China, ZRTDX is a qualified manager of private security funds that provides professional asset management services through the issuance of private funds, being specifically specialized in private equity investments, comprehensive services for public companies, security investments and cash management. ZRTDX has a competent professional team with rich experience in operations, project development and risk management and also has a long-standing record of excellent performance.

Website:

ZHONGRONG FUND

Zhongrong Fund, formerly known as SSGA Fund, was established after being approved by CSRC on May 16, 2013, finalizing registration in SAIC and obtaining a business license on May 31, 2013. Today, as permitted by CSRC, it is qualified to engage in fund collection and sales, general asset management, asset management for special clients and other related business with a current paid-in capital totaling 1.15 billion yuan.

The ownership structure of the company sees ZRT contributing 51% of shares and Shanghai Rongcheng Investment Co. Ltd. contributing 49%. ZRF adopts an improved risk-control system, which targets client demands and follows laws pertaining to fund development, while relying on the powerful strengths of shareholders and utilizing a steady operating style. As it makes its presence known in various aspects and directions, the company strives to create compelling values for its investors and is devoted to providing them with long-term and stable returns.

Zhongrong International Capital Management Limited (HongKong)

Carrying the No.4 and No.9 licenses issued by SFC, ZRICM is engaged in direct investment and asset management business to provide financing and investment support to both sides of cross-border transactions. Leveraging upon the unique advantages of extensive clients network in China and direct access to international capital market in Hong Kong, ZRICM is specialized in providing integrated financial solutions including direct investment and asset management.

The ZRT Family Office takes full advantage of ZRT’s capacity in trust and investment banking as well as its cherished partnerships with those in selected and famous law firms, accounting firms and other professional service organs. With family funds as the carrier and family trusts as the major instrument, the office dynamically designs and executes comprehensive solutions for family clients so that stage targets may be achieved for the development of any given household.

The ZRT Family Office was founded to assist households in arranging and distributing the control, management and income rights of families and family businesses to avoid any potential or actual issues of governance while handling relations among family members, corporate shareholders and corporate managers, all with the intent of establishing and maintaining the sustainable inheritance of family wealth as well as the continued operation of family businesses.

This office acts as a general coordinator of sorts, helping families select appropriate and beneficial institutions, people, assets and services and as a result, becoming a professional manager of family affairs and wealth.

The purpose of the ZRT Family Trust is to allow grantors (family clients) to entrust family assets to ZRT to assist them for purposes of inheritance, protection, management and the appreciation of family wealth. ZRT, as trustee, complies with the wills of such grantors and consequently manages, uses and handles trust properties insofar as it is able and also distributes trust-related benefits to family beneficiaries in strict accordance with the contracts it signs.

ZRT advocates the inheritance of both wealth and wisdom. We believe that it’s not just institutional protection, values, or an overall entrepreneurial atmosphere that promotes the creation and inheritance of material wealth; wisdom is even more critical, as it generates, protects and ensures the sustainable inheritance of wealth. Entrepreneurs hope their future generations will be able to be wise in how they live their lives, and family trusts, in and of themselves, can be said to embody a certain level of wisdom.

At ZRT, we show respect for humans and their inheritance. With a sharp eye on how material wealth is passed from one generation to the next, we are able to integrate wisdom into this very process, all while discussing family culture and values, exploring the best avenues for educating and raising children and considering various methods for improving family and corporate governance within a given trust system and culture. Through our efforts and arduous study, we find the best ways to incorporate trust with charity and help our clients’ families secure long-lasting and sustainable prosperity.

Asset Protection

1. Insulation of corporate assets from family wealth: Used to set up a firewall between corporate assets and family wealth and prevent corporate financial or startup crises from endangering family lives.

2. Debt protection: Used to shield grantor and beneficiary creditors as best as possible from claiming trust properties through asset selection and structural design.

Distribution Plans for Children

1. Special management for the disbursal of funds throughout the various major stages of a child’s growth (such as education-related, medical and travel expenses).

2. Certain control rights maintained by parents, with trust benefits and beneficiaries able to be adjusted so that children can be encouraged to grow and become successful.

3. Funds allocated for special use and through targeted payment to prevent children from spending lavishly, thereby achieving wealth accumulation and sustainable operation.

4. Uneven distribution or asset outflow avoided for families with many children through different marriages.

Elderly Care

1. Trust assets managed for the long term to help grantors accumulate funds to be disbursed as necessary for elderly family members.

2. Protection against relatives of grantors taking away property while grantor is still alive.

3. Proper disbursement of wealth among designated family beneficiaries or charity organizations upon death of grantor.

Postnuptial Protection

1. Property outflow prevented in the event of separation or divorce, with trust property separated as best as possible from a given couple’s common property.

2. Mixture of property avoided between two spouses.

3. More acceptable than prenuptial agreements.

Artwork (Collection) Inheritance

1. roper inheritance of artwork and collections ensured for future generations.

2. Children spared the burden of having to maintain and keep such items.

3. Proper handling of problems encountered with artwork investment and other issues.

Protection for Other Designated Family Members

1. Used to benefit other designated family members.

2. For avoiding extra problems caused by giving such family members money directly.

3. To avoid disagreements between parents-in-law and sons/daughters-in-law concerning the grantor’s desired distribution of property.

Property Insulation before Emigration

1. Investment opportunities and rational yields for money that has not been provisionally transferred.

2. Reduced burden when declaring assets.

Charity

Used to improve family image, establish family brands and improve family cohesion and cognition.

Service line: +86 010-58878027

Email: zrtfo-client@zritc.com

ZRT Wealth, developed by Zhongrong International Trust Co. Ltd. (ZRT), is the first wealth management brand ever developed within the Chinese trust industry. Relying on ZRT’s strong ability in assets management as well as its extensive investment channels, ZRT Wealth provides high-end clients with comprehensive private banking services and is dedicated to becoming the best independent wealth management organization in all of China.

With a focus on client needs, ZRT Wealth is the first in China to take on an exclusively customized wealth management model, and by maintaining its tactic of using only high-quality products, ZRT Wealth professionally screens financial investment products and provides asset configuration, domestic and overseas investment management and investment portfolio management, thus becoming greatly favored by high-net-worth clients.

ZRT Wealth is dedicated to serving high-net-worth clients and has established a comprehensive and open platform for purchasing and selling investment products. Taking each individual client’s situation into account, ZRT Wealth recommends the most proper investment products or provides customized wealth management services as it provides assistance to approximately 24,000 high-end individual and 900 institutional clients, through which the company raised more than 200 billion yuan in 2016.